Travel

Why Multi-Currency Checkouts Improve Travel Customer Experience

Introduction: The Global Nature of Travel & Payments

Traveling has become more international than before. Whether it is a solo European traveler or a family attending a holiday in Southeast Asia, a travel business has a continental, cultural and, most importantly, a currency spread audience.

However, a lot of travel platforms continue to use a universal payment system, where all users are supposed to make transactions using one default currency, usually, USD or EUR. This forms an unwanted obstacle to an otherwise smooth digital experience.

Making customers figure out the unfamiliar exchange rate or getting surprised by bank fees added after the fact also at checkout affects the trust, but also increases the cart abandonment rates.

Multi-currency checkouts are no longer a nice-to-have in an industry where time is of the essence, complexities abhorred and trust is key.

At OneClick Travel Tech, we understand that your platform needs to serve users wherever they are, in the way they expect. That’s why we help travel companies integrate intelligent, real-time multi-currency payment solutions that elevate user experience and boost conversions.

Let’s explore how this small but powerful upgrade can transform your travel business.

The Problem with Single-Currency Checkouts

Most of the traveling websites seem to invest much in visuals and features along with quick loading times, but one step of the customer experience that is commonly forgotten is the checkout. To a customer that is prepared to make a booking, this point must be smooth and safe. However, when you have a platform that does not facilitate more than one currency, it subtly introduces friction that might harm the trust, lower conversion rates, and eventually make you lose bookings.

Secret Conversion Charges

When a customer is compelled to use a foreign currency, his/her bank or credit card will often include a hidden foreign conversion fee- normally between 2.5 % and 5%. The problem with this is that the majority of the users are not aware of this fee being charged until after the transaction when they either look at their bank statement or get a payment alert. This unexpected expense transforms what seemed like a good bargain to a bad experience. And although it may not be your platform that is directly to blame about the fee, the anger is usually directed at you - the travel provider - because the checkout failed to communicate this. These minor failures may, in the long run, destroy customer loyalty and erode your brand image.

Abandoned Carts

As soon as a user is presented with prices that are in a foreign currency, they flinch. They begin to wonder what they are exactly being charged. Others will follow the new tab to find the exchange rates. Others will attempt to compute the cost using mental mathematics of the estimated amount. In any case, such an additional effort generates friction - and friction causes drop-offs. What ought to have been an easy booking appointment becomes a burden of decision-making. This uncertainty can and does frequently lead to the mobile user abandoning their cart and moving on to a competitor who isclear about their pricing locally to begin with.

Lack of Trust When Local Pricing Isn’t Shown

In travel, trust is necessary. People are paying substantial sums of money to have an experience in future which has not yet occurred, therefore trust in your site is not negotiable. Customers become detached when the local pricing is not displayed. They can ask themselves whether your site is international or even valid. This is particularly happening to the first-time users or those who travel from the countries, where global transactions are not so frequent. The sight of their own money creates confidence. It reads them: "This platform gets me. It is designed by and meant to fit a person like myself. Even without taking into account that local touch, you stand the chance of putting off a big percentage of your global audience.

Poor Transparency Creates Perceived Unfairness

Unless your prices are uncompetitive, lack of currency transparency can make them seem so. The fact that users are not made aware of the exact amount they are being charged until after the payment has been processed -or even worse after foreign exchange fee has been applied- gives the impression of being cheated. That impression holds. Customers will think that they have been scammed to pay higher than what was agreed on hence poor reviews, complaints, or refund demands. Depending on word-of-mouth and online ratings to make their purchasing decisions, perceived unfairness can significantly hurt your growth potential in an industry where buyer decisions depend largely on word-of-mouth and online ratings.

The Opportunity You’re Missing

In a time where travel is increasingly mobile and cross-border, checkout experience can make or break your conversion funnel.

A small feature like multi-currency support could mean the difference between a completed booking and a lost customer.

That’s where we come in.

At OneClick Travel Tech, we specialize in building conversion-optimized, global-ready travel platforms — complete with seamless multi-currency checkout systems. From real-time exchange rates to geo-location-based currency detection, we make sure your users get a payment experience that feels local, fast, and frictionless.

Because in travel, experience is everything — and payment is the final impression you leave.

How Multi-Currency Checkout Solves These Issues

When single-currency checkouts turn out to be confusing, frustrating, and resulting in drop-offs, then multi-currency checkouts are the remedy that is bound to do just that. They are not a luxury, but a conversion driver of the new travel platforms. Offering users an insight, ease and control during the payment point, multi-currency support feature has a direct influence on the traveler confidence and your business profitability.

1. Displays Prices in a User’s Local Currency

The sight of familiar currency immediately relaxes the customers. It eliminates the psychological aspect of currency conversion and localizes the shopping experience by making it more personal.

2. Reduces Uncertainty at Checkout

Once they aspect the price they definitely will be charged, the users are much more apt to finalize the reservation. Multi-currencies support gets rid of any fear of additional charges or final totals.

3. Builds Trust with Global Travelers

The presentation of local currencies indicates that your platform is aware of, and appreciative of where the customer is located. This little act creates confidence, particularly among first time users.

4. Eliminates Hidden Charges

Multi-currency systems eliminate the surprises after making a payment, as they display the final amount payable clearly. Zero FX fees will result in a reduction of refund requests and disagreements.

5. Boosts Mobile Conversions

In mobiles, less is more. With multi-currency support, there is no need to leave the app to verify the rates, which can aid in eliminating drop-offs during mobile checkout.

6. Supports Better Communication

Customer requests on pricing reduces sharply when prices are well displayed in a format that they understand. It also makes customer service easier and enhances the general satisfaction.

7. Enhances Perception of Fair Pricing

When users see same prices that make sense, they feel they are being charged reasonably. This will enhance the perception of the brand and make repeat bookings.

8. Improves Conversion and ROI

Bottom line, multi-currency checkout equals more completed bookings, less abandoned carts and an improved ROI. That is a win-win to the traveler and your business.

Benefits for Travel Brands

While multi-currency checkout clearly enhances the user experience, its impact on business performance is even more powerful. It’s not just about convenience — it’s about driving real growth. Let’s explore how this one feature can elevate your brand’s KPIs and global potential:

Higher International Conversion Rates

By enabling users to see the payment and also pay in their currency, the chances of them making the booking are much higher. This results in much increased conversion of international traffic - browsers to buyers.

Reduced Cart Abandonment

A lot of checkouts are abandoned due to lack of surety over prices. Multi-currency checkout eliminates this uncertainty, and you get to reclaim revenues that would have been lost.

Stronger Global Brand Presence

Multi-currency tells the world: “We built this for you.” It makes your platform feel local, even when you’re global — building brand loyalty across regions and languages without changing your core identity.

Enhanced Mobile & App Experience

Mobile Attention spans are shorter and expectations are higher. With local currencies displayed at the top, you reduce the thinking effort and the flow is smooth. Fewer taps, more bookings - it is a UX victory.

Better B2B & Corporate Travel Appeal

Clarity of prices is not open to negotiation when it comes to travel managers. Whether you need to pay in employee trips or large group bookings, viewing local currency makes internal approvals, reimbursements and planning a lot easier - so your platform makes the smart move to business clients.

Improved Analytics & Targeting

By turning on multi-currency you are not only assisting the user, you are assisting your marketing department. Having the region-specific pricing data, you will be able to analyze what currencies convert better and base the campaigns on these needs, as well as identify the untapped markets hassle-free.

Fewer Support Queries & Refund Requests

Unexpected fees are not enjoyed by anybody. With upfront final pricing, you will eliminate confusion, chargebacks and support tickets radically. The result? More satisfied passengers, slimmer customer care teams and reduced after-booking problems.

Flow Meets Function

Customers do not need to have a calculator to reserve a flight. And brands do not need to lose money to avoidable friction. This is why multi-currency checkout is not an option anymore it is a building block of success in the global market.

Key Features of a Multi-Currency Checkout

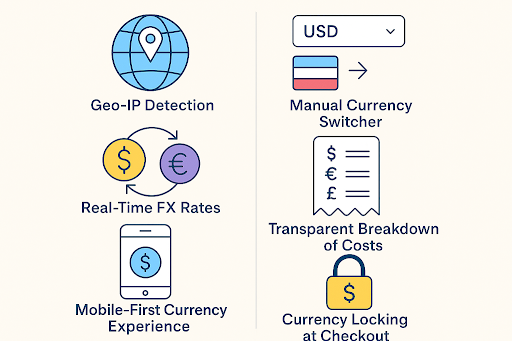

Adding a multi-currency checkout isn’t just a backend fix — it’s a customer experience upgrade. Today’s travelers expect convenience, clarity, and control. Let’s explore the essential features that turn your payment flow from standard to world-class:

1. Geo-IP Detection: Personalization from the First Click

Why make users dig through settings when your site can automatically display their local currency based on location?

✅ Instantly adjusts currency based on user’s IP

✅ Enhances trust by showing familiar pricing

✅ Reduces bounce from confused first-time visitors

Pro Tip: Combine Geo-IP with language auto-detection for an even smoother landing experience.

2. Manual Currency Switcher: Let Them Choose

Not every traveler books from their home country. Some prefer to pay in USD, others in GBP — flexibility is key.

✅ Offers users control when auto-detection isn’t accurate

✅ Ideal for digital nomads and cross-border travelers

✅ Encourages experimentation without frustration

“As a traveler, nothing’s worse than being locked into a currency you can’t understand.”

3. Real-Time FX Rates: No Surprises, Just Accuracy

Nothing damages trust like stale conversion rates. Real-time FX updates ensure what users see is what they pay.

✅ Pulls updated rates from reliable sources

✅ Avoids last-minute payment discrepancies

✅ Supports transparent, dynamic pricing

Stat alert: 60% of users feel anxious when they see currency mismatches at checkout — this solves it.

4. Transparent Breakdown of Costs

Taxes, fees, and service charges should never feel hidden. Show the full picture — in the right currency.

✅ Breaks down final cost clearly

✅ Includes VAT, GST, or regional fees

✅ Increases confidence and reduces refunds

Your checkout should feel like a receipt, not a riddle.

5. Mobile-First Currency Experience

80% of bookings are now mobile. If your multi-currency UI isn’t mobile-optimized, it’s already outdated.

✅ Responsive display of prices across screens

✅ Smooth currency switcher even on smaller devices

✅ Fast-loading FX updates with caching

No one wants to pinch-zoom to see how much they’re paying.

6. Currency Locking at Checkout

Fluctuating prices during a transaction cause mistrust — and drop-offs.

✅ Locks selected currency for the session

✅ Prevents price shocks from mid-checkout changes

✅ Boosts payment confidence and completion rates

Built for Travel. Backed by Tech.

At OneClick Travel Tech, we help travel platforms and OTAs implement multi-currency checkouts that don’t just look good — they perform. From smart FX syncing to regional gateway integrations, our solutions are battle-tested across geographies.

The Tech Stack Behind Multi-Currency Checkouts

It’s easy to get excited about offering prices in local currencies — but behind the scenes, there’s some serious tech magic at play. From real-time exchange rates to syncing your CRM, let’s decode the core technologies that power smooth, secure, and scalable multi-currency checkouts.

1. Real-Time Currency Conversion APIs

If you want accurate, up-to-date pricing for global users, this is where it begins.

What is it?

Currency conversion APIs fetch live FX rates from financial sources and update your system accordingly.

Popular options:

Why it matters:

✔️ Eliminates mismatched pricing

✔️ Boosts customer trust

✔️ Updates rates in real-time or on a schedule

Pro Tip: Choose an API with high uptime and historical rate data for auditing.

2. Payment Gateways with Multi-Currency Support

You need a payment processor that doesn’t just accept different currencies — it should settle, refund, and track them correctly.

Trusted options include:

- Stripe (global-first with auto-conversion)

- Razorpay (great for India + global)

- PayPal, Paystack, Flutterwave (regional strengths)

Features to check:

✔️ Currency auto-detection

✔️ Local method support (UPI, iDEAL, etc.)

✔️ PCI-DSS compliance for security

✔️ Auto-refund in original currency

Pro Insight: Not all gateways settle in the currency collected. Confirm settlement logic before going live.

3. Localized Checkout UI — Not Just Language, But Feel

It’s not enough to show a different symbol — the entire checkout experience must adapt to local expectations.

What this includes:

- Currency symbols & number formats (e.g., ₹ vs €)

- Language toggles

- Tax/VAT display logic

- RTL vs LTR formatting (especially for Arabic/Hebrew)

On mobile? The layout and responsiveness must shine — one cluttered screen, and you’ve lost the user.

4. Backend Sync: Invoicing, Refunds & CRM Compatibility

Once a booking is made, every system needs to understand what happened — in the right currency.

Systems that need syncing:

- CRM (for region-specific targeting)

- Invoicing (currency-tagged for accounts team)

- Refund engine (must auto-match original payment type + currency)

- Analytics (to segment users by currency/region)

Why it's critical:

✔️ Avoids accounting errors

✔️ Supports detailed reports per region

✔️ Enables smart retargeting campaigns

At OneClick Travel Tech, we offer full middleware and webhook solutions to make sure nothing slips through the cracks.

Bonus: Make It Scalable & Secure

When building your multi-currency system, don’t forget:

- Scalability: FX updates should handle spikes during promo/seasonal rush

- Security: Always use HTTPS, encrypted API keys, and token-based sessions

- Fallbacks: If FX API fails, have a backup or fixed-rate mode to avoid user impact

FAQs

Q: Can I add multi-currency to an existing travel booking engine?

Yes! With the right API layer and gateway configuration, we can extend your current system without a rebuild.

Q: Will this affect taxes and invoices?

Only positively — your invoices will be cleaner, and region-wise accounting becomes easier to manage.

OneClick Travel Tech: Your Travel Checkout Partner

We specialize in building and integrating multi-currency, multi-market checkout systems for travel brands, OTAs, and DMCs. Whether you need:

- A fully localized mobile-first checkout

- Regional gateway integration

- FX sync and compliance logic

- Backend CRM or ERP compatibility

—we handle it all.

Real Examples: Brands Winning with Multi-Currency

Still consider whether multi-currency checkout is worth investing in? Well, all you need to do is to open your eyes and see how the most popular travel platforms exploit it to their benefit. And these companies are not simply adding local currency as a feature, but make it a central part of their international expansion plans.

Here’s how they do it:

1. Booking.com – Real-Time FX That Builds Trust

Booking.com does not leave the conversion of currency as the final step. It does not do that instead it shows real-time converted prices across the user path - search results to checkout.

Why it works:

✔️ Clear pricing: the price in the currency of the user choice

✔️ No surprise at the last action

✔️ Establishes a rapport of trust with the travelers in 220+ countries

Impact: Stronger global retention, reduced booking friction, and happier users — especially in price-sensitive markets.

2. Airbnb – Currency Customization Across Devices

It doesn't Airbnb matter whether you are browsing on desktop in the UK or on a phone in Brazil, the company displays currencies based on where you are and how you make a reservation.

What is Powerful about it:

✔️ Sub seamless currency adaptation on mobile, app and web

✔️ User override option on real time FX adjustments

✔️ Localized tax breakdowns based on location

Lesson: A consistent multi-currency experience across devices equals higher mobile conversions.

3. Skyscanner – Geo + Language + Currency Combo

Skyscanner goes even further and identifies your IP and language preferences as well as browser locale to provide the most native experience possible in an instant.

Key takeaways:

✔️ Auto-switches currency and language on homepage load

✔️ Users can override with manual preferences

✔️ Integrates local payment methods for different markets

Result: One of the most globally loved platforms — known for making international travel search feel personal.

4.Trip.com – Currency by Traveler Origin, Not Just Location

Trip.com knows that a lot of users make bookings on the go - thus it does not simply depend on location. It even monitors the history and profile information of the user in order to automatically determine the currency.

Why it’s a smart move:

✔️ Perfect for digital nomads, expats, and frequent flyers

✔️ Reduces confusion among cross border users

✔️ Makes the pricing recognizable no matter the location

Impact: Greater customer loyalty from global users who feel understood and accommodated.

The Future of Travel Payments: A Journey Through Tomorrow

Picture this: Emma, a London digital nomad is drinking coffee in a Chiang Mai cafe. She takes out her phone and searches to reserve a diving trip to the Philippines. Before she has time to open her preferred traveling application, it already knows her location, understands her historical booking patterns, and offers pricing in GBP - although she could also choose to pay in Thai Baht or crypto, or even use the balance in her travel wallet, which she preloaded.

No confusion. No FX surprise. No delays.

Borderless, just smooth checked out Smart.

This isn’t a far-off vision. It’s where travel payments are heading — and fast. Here's what the road ahead looks like:

Checkout That Travels With You

Checkouts tomorrow will not be freezing when you change countries. They will track your experience, as the currency, language, and even payment methods switch automatically in real time - with no manual switches at all.

Travel is dynamic. Your payment system should be too.

FX Without the Friction

Every transaction will be driven by real-time exchange rates rather than the static conversions or estimates. They will be able to view what they are being charged, and will not get any unpleasant surprises when their statement is due.

Transparency builds trust — and trust drives bookings.

Wallets, Not Just Cards

Regular travelers will be interested to load money in different currencies USD, EUR, AED and pay accordingly to the destination. It is effectively a Revolut-style wallet, inside your travel app.

It’s not about payment methods anymore. It’s about payment flexibility.

Say Hello to Crypto (and Goodbye to Borders)

The use of Bitcoin, USDT, and other digital currencies will become a normal option to high-frequency travelers, particularly in the areas with a fluctuating currency or where banks are not widely available.

It’s fast. It’s global. And it’s the choice of the next generation of travelers.

AI-Powered Checkout = One Step, Not Five

AI will remember the preferences of its users and will do the majority of the flow instead of asking the user to make a choice, fill in, toggle and confirm. The future checkout is not fixed, but intelligent, all the way through detecting the optimal currency, to the implementation of loyalty discounts.

The less your user thinks, the faster they book.

Conclusion

Frictionless Payments Are No Longer Optional — They're Expected

In the highly interconnected travel ecosystem of today, your customer might be planning a weekend trip out of Tokyo, a business trip out of Berlin or a honeymoon out of Sao Paulo. What do they have in common? The belief that payment must be immediate, transparent and local - in their familiar currency, via the means they recognise.

It may come as no surprise that a seamless multi-currency checkout is not a mere convenience, but a strategic growth lever. It enhances conversions, minimizes drop-offs, facilitates trust and demonstrates to global consumers that your brand was designed with them in mind.

At OneClick Travel Tech, we help travel companies go global — the smart way. From multi-currency engines to AI checkout optimization and crypto-ready integrations, we build the tech stack your future customers already expect.

Ready to make your travel checkout truly global?

Let’s talk.

Contact us today to integrate smart, scalable multi-currency solutions into your platform.

Because in travel — every transaction is a trust-building moment.

Your Tech Partner for Scalable Travel Growth

We’re here to help you shape your business, so reach out to us today.